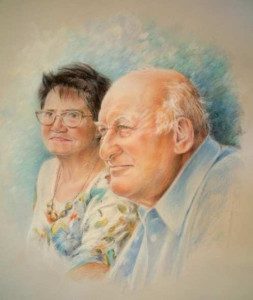

College Tuition: Discover How Grandparents Can Help Their Grandchildren and Save Taxes Too

How Grandparents Can Help Grandchildren and Save Taxes Too With college tuition coming due, families should consider tax efficient ways to pay for these expenses. Grandparents who wish to help their children with tuition costs can take advantage of some special gift tax breaks. Grandparents have the usual annual present interest gift tax exclusion (now… Read more »